RealEstateNews

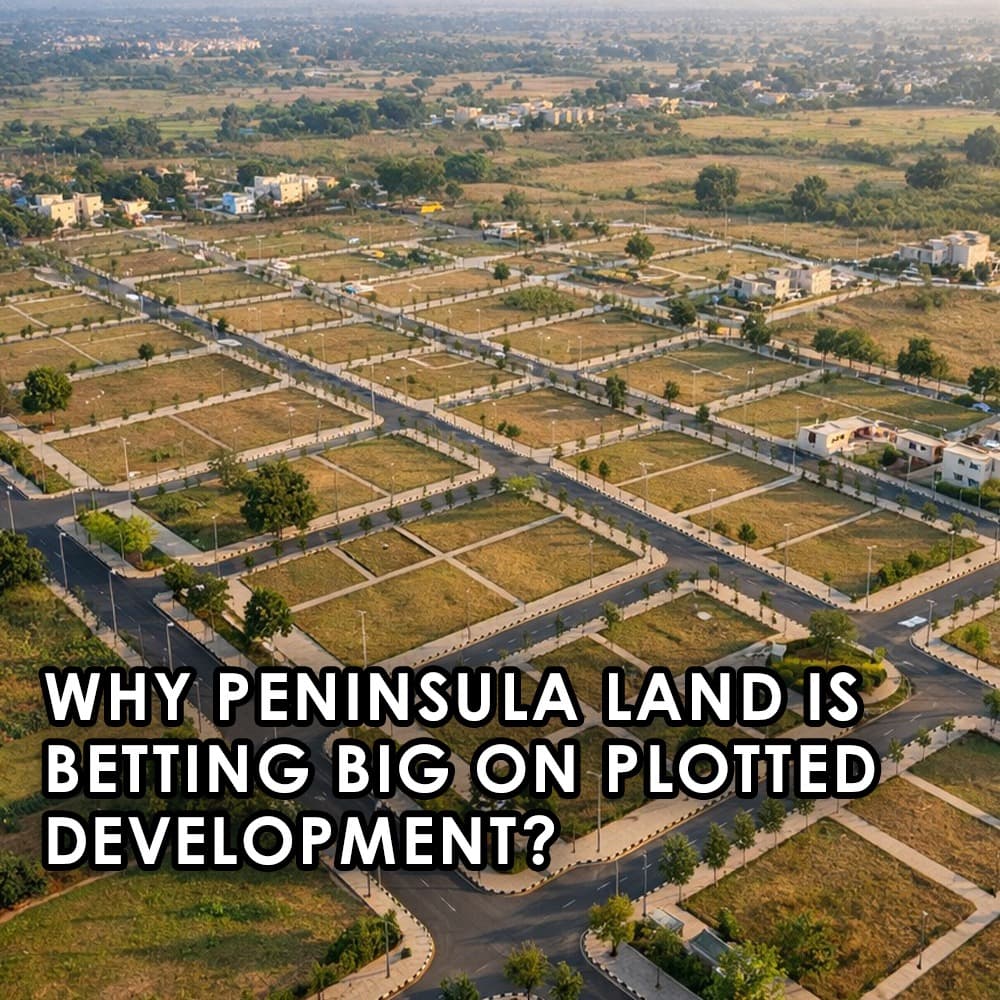

Peninsula Land's Plotted Development Strategy: A New Direction for Mumbai Real Estate

Peninsula Land is strategically shifting to plotted developments in Mumbai, driven by buyer demand for flexibility and lower costs. This approach offers developers faster monetization and reduced risk, reshaping the future of Indian real estate.