Budgeting Tips for Middle-Class Homebuyers in India

Summary

Smart budgeting is crucial for middle-class homebuyers in India. Key strategies include realistic EMI limits, substantial down payments, accounting for all costs, and long-term financial planning for comfortable homeownership.

Introduction

For middle‑class families in India, buying a home is often the biggest financial decision of a lifetime. It is not just about owning property—it represents security, stability, and years of disciplined savings. However, without proper budgeting, this dream can quickly turn into financial pressure. Smart budgeting helps buyers purchase a home without compromising daily needs or future goals.

Start With Your Real Monthly Income

Budgeting should always begin with net monthly income, not gross salary. This means calculating take‑home pay after taxes and deductions. Using inflated income figures leads to over‑borrowing and long-term stress.

Fix a Comfortable EMI Limit

One of the most important budgeting rules is deciding how much EMI you can comfortably pay every month. The EMI should allow room for household expenses, savings, and emergencies. Stretching EMIs to the maximum approved limit may lead to financial imbalance.

Plan a Strong Down Payment

Middle‑class buyers should aim to save a healthy down payment before purchasing. A higher down payment reduces loan burden, lowers interest outflow, and improves long-term affordability. Depending entirely on loans increases financial risk.

Don’t Forget Additional Purchase Costs

Many buyers budget only for the property price and loan EMI. However, stamp duty, registration charges, GST (where applicable), brokerage, and legal fees add significantly to the overall cost. These expenses should be planned in advance.

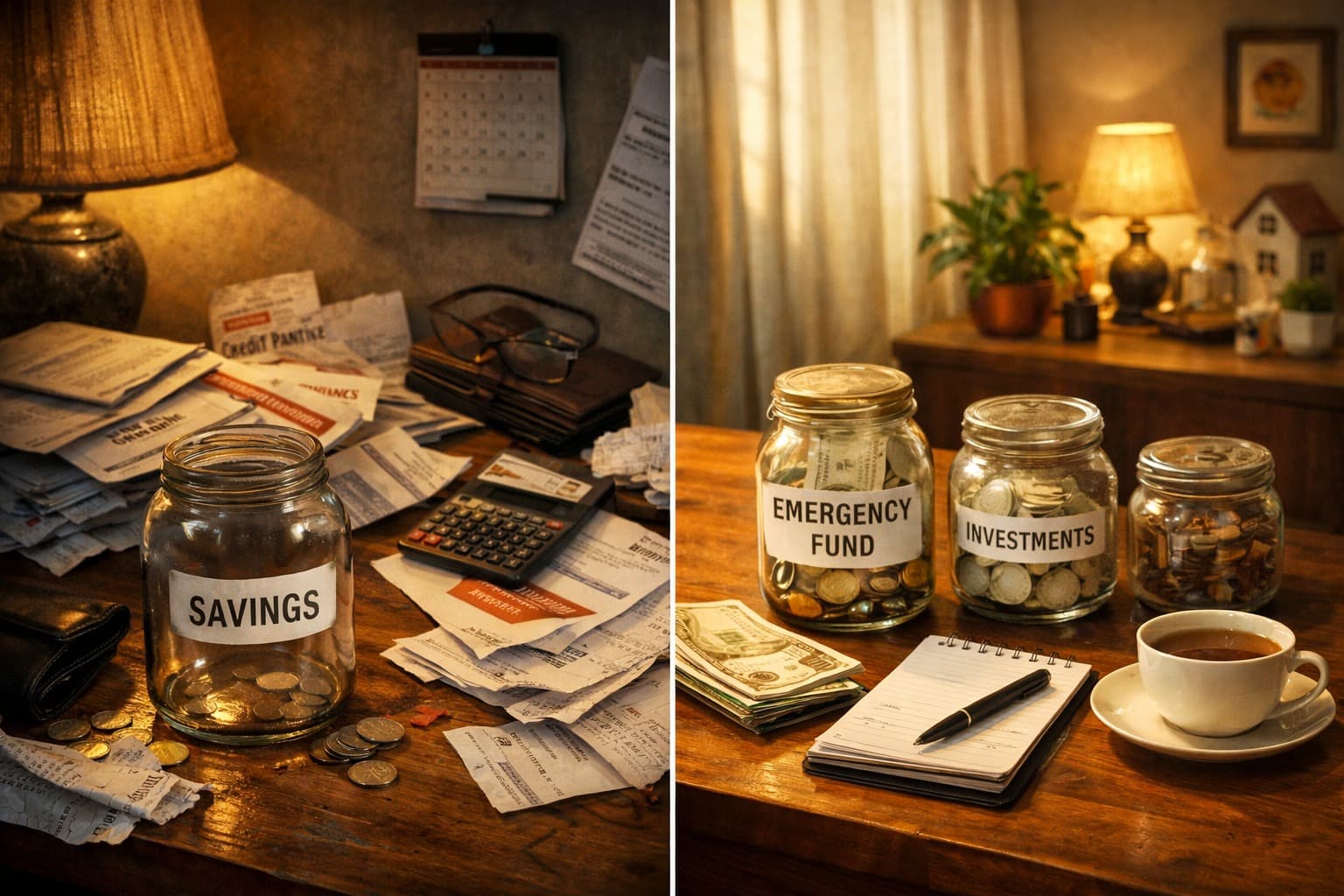

Keep an Emergency Fund Intact

Buying a home should not wipe out all savings. Middle‑class families must maintain an emergency fund for medical needs, job changes, or unexpected expenses. A home purchase should enhance security, not eliminate it.

Evaluate Total Ownership Cost

Monthly expenses don’t end with EMIs. Maintenance charges, property tax, utilities, insurance, and repair costs add to the budget. Buyers should calculate total ownership cost before finalising a purchase.

Avoid Over‑Dependence on Future Income

Many buyers assume salary hikes will make EMIs easier in the future. This is risky. Budgeting should be based on current income levels. Future growth should act as a cushion, not a necessity.

Choose the Right Location and Size

Middle‑class buyers often benefit from choosing practical locations instead of premium addresses. Slightly smaller homes or emerging areas can offer better financial balance without sacrificing comfort.

Reduce Existing Financial Liabilities

Before buying a home, it is wise to clear or reduce other loans such as personal loans or credit card dues. Lower fixed obligations improve loan eligibility and reduce monthly pressure.

Be Careful With Loan Tenure

Longer loan tenures reduce EMIs but increase total interest paid. Buyers should select a tenure that balances affordability with long-term financial efficiency and allows prepayment flexibility.

Don’t Base Decisions Only on Tax Benefits

Tax benefits on home loans are helpful, but they should not drive the purchase decision. Buying a larger home just to save tax can strain finances. Tax savings should be a bonus, not the justification.

Compare Home Loan Offers Carefully

Interest rates, processing fees, and repayment flexibility differ across lenders. Middle‑class buyers should compare multiple offers and choose loans that allow easy prepayment and refinancing.

Keep Lifestyle Expenses in Check

After buying a home, lifestyle expenses often increase. Budgeting should include realistic lifestyle costs so that homeownership does not force uncomfortable compromises.

Avoid Emotional Buying

Peer pressure, limited‑period offers, or fear of missing out can push buyers into poor decisions. Middle‑class homebuyers benefit the most from calm, numbers‑driven planning.

Plan for the Long Term

Home buying is a long‑term commitment. Budgeting should consider children’s education, retirement planning, and healthcare needs. A home should fit into life goals, not replace them.

Final Perspective

For middle‑class families, smart budgeting is the foundation of stress‑free homeownership. A well‑planned purchase ensures comfort, stability, and peace of mind for decades. Owning a home should feel secure—not financially overwhelming.

Summary

Middle‑class homebuyers must budget carefully by fixing a comfortable EMI, planning a strong down payment, accounting for additional costs, and maintaining emergency savings. Avoiding over‑reliance on future income, controlling liabilities, and choosing practical property options are key. Thoughtful budgeting turns homeownership into a long-term asset rather than a financial burden.