Unlocking Premium Real Estate: The Power of Investment Syndication in India

Summary

This blog post provides comprehensive insights and practical guidance on Unlocking Premium Real Estate: The Power of Investment Syndication in India. It covers key concepts and offers valuable tips for readers.

The Role of Syndication in Investments

Let’s be real for a moment. Not everyone has crores lying around to buy a fancy office tower in Gurgaon, a shiny mall in Pune, or a premium commercial block in Bengaluru. For most of us, just buying a 2BHK flat feels like climbing Everest. But here’s the twist — what if I told you that you can own a piece of those premium properties without selling your kidney or winning a lottery?

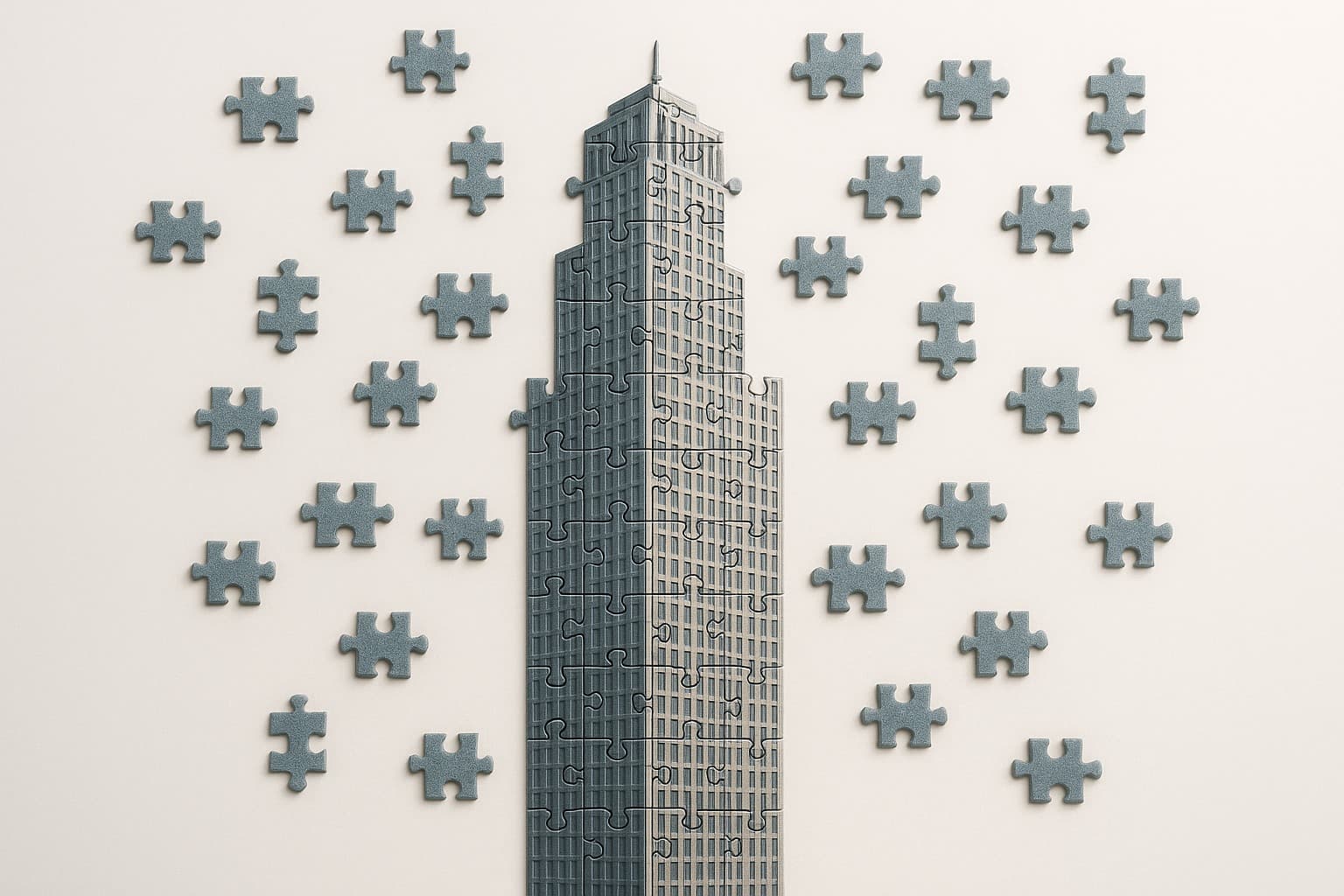

Welcome to the world of investment syndication. Sounds like a big financial term, right? But it’s actually quite simple. It’s just people like you and me coming together, pooling money, and investing in something bigger than what we could do alone. It’s teamwork, but with rupees instead of cricket bats.

So, What Exactly is Real Estate Syndication?

Imagine you and 20 others put money into one big project — let’s say an IT office space near Hinjewadi, Pune. Alone, you’d never be able to buy it. Together, you can. That’s property syndication in its simplest form.

Investor pooling: Many investors contribute smaller chunks.

Managed by pros: A syndicator (like the team captain) handles everything — buying, paperwork, managing tenants.

Returns shared: Whatever rental income or appreciation comes, is divided among the group.

Basically, you get the benefits of owning big real estate without the massive headache.

Why is Syndication Catching Fire in India Right Now?

Think about it. Property prices are skyrocketing, especially in metros. A Grade-A office building costs hundreds of crores. Even luxury residential plots are beyond reach for middle-class investors.

That’s where the real estate syndication model India fits in perfectly. With as little as ₹5–10 lakhs, you can get your foot in the door. And in 2025, as commercial real estate in India grows, syndicate investment opportunities are becoming the smart way in.

It’s like booking a seat on a flight instead of buying the whole airplane. You don’t need to own everything to benefit.

How Does Syndication Help Small Investors?

If you’re someone who always thought, “Property is only for big players, not people like me,” then syndication is the bridge between your dreams and reality.

Affordable entry: Instead of ₹1 crore, you may need just ₹10–15 lakhs.

Diversification: You can invest in multiple projects — say part of a mall in Delhi and part of a warehouse in Chennai.

Passive income: You don’t chase tenants for rent; the syndicator handles it and transfers your share.

This is the real role of syndication in Indian real estate investments — turning “impossible” into “possible” for regular investors.

The Sweet Benefits of Group Investing

Why are people talking about group investing via real estate syndication so much? Because it just makes sense.

Access to bigger deals you couldn’t touch alone.

Professional management so you don’t drown in legal or tenant issues.

Shared risk so if things go south, the burden isn’t only on you.

Steady rental income and long-term growth.

Basically, syndication is like joining a cricket team instead of playing gully cricket alone — more players, better chances of winning, and fewer personal headaches.

But It’s Not All Sunshine ☀️

Let’s not sugarcoat it. Like every investment, pros and cons of syndication in real estate exist.

You give up control — the syndicator calls the shots.

Liquidity is low — you can’t just sell your share like a stock.

You’re dependent on the syndicator’s honesty and skill.

Market risks — if property prices drop, so will your returns.

So, while syndication is exciting, it’s not for those who want 100% control or instant cash-outs.

Is Syndication Safe in India?

This is the burning question: “Is syndication safe for property investment in India?”

The answer: it can be, but only if you’re smart.

Choose regulated, reputed syndicators.

Read the fine print carefully — who’s managing what, how profits are split, when you can exit.

Avoid shady WhatsApp groups promising “guaranteed 30% returns” — those are usually traps.

With the right syndicate, yes, it’s safe. With the wrong one? You’ll regret it.

Solo vs Syndication – Which Makes More Sense?

Going solo: More control, more profit, but huge risk and high capital.

Syndication: Smaller entry, shared risk, professional management, but limited say.

In today’s India, where premium real estate is priced like gold, syndication feels like the smarter path for most investors.

A Real Story

Let me share one. A group of investors in Bengaluru came together in 2023. Each contributed about ₹12 lakhs. Together, they bought a part of a commercial property leased to an MNC.

Alone, none of them could afford it.

Together, they not only got steady rental income but also saw capital appreciation within two years.

For many of them, this was their first-ever commercial real estate deal.

That’s syndication in action. That’s why it matters.

Final Thoughts

The role of syndication in investments is to make real estate less of a rich-man’s game and more of an open field where everyone can participate.

It lowers the entry barrier.

Spreads out risk.

And gives regular investors a taste of premium properties.

Of course, it’s not perfect. But with the right due diligence, investment syndication can be one of the smartest ways to build wealth in India’s booming property market.

Summary (100 words)

Investment syndication is changing how Indians invest in property. Instead of needing crores, investors pool funds to buy high-value projects and share returns. The real estate syndication model India is popular in 2025 because it makes premium projects affordable, spreads risk, and provides professional management. Small investors benefit from diversification and steady income without tenant hassles. However, risks include lack of control, low liquidity, and dependence on syndicators. With proper due diligence and trusted partners, group investing via real estate syndication can be a safe and powerful wealth-building strategy for Indians who want more than just a flat.