The Psychology of Real Estate Investing in India

Summary

This blog post provides comprehensive insights and practical guidance on The Psychology of Real Estate Investing in India. It covers key concepts and offers valuable tips for readers.

The Psychology of Real Estate Investing

Imagine this: You step into a bright, airy apartment, sunlight pouring in through the windows, and immediately feel a connection. Your heart whispers, “This is mine!” but your brain quietly asks, “Wait… is this really the right decision?” That tug-of-war between emotion and logic is at the core of real estate psychology.

Whether you’re a first-time buyer in Mumbai, a seasoned investor in Bengaluru, or an NRI looking at Pune, the way you think about property — your investment mindset — can make or break your returns. In fact, understanding the psychology of real estate investing India is often the invisible edge that separates successful investors from those who lose money or miss opportunities.

How Investor Behaviour Shapes Real Estate India 🏘️

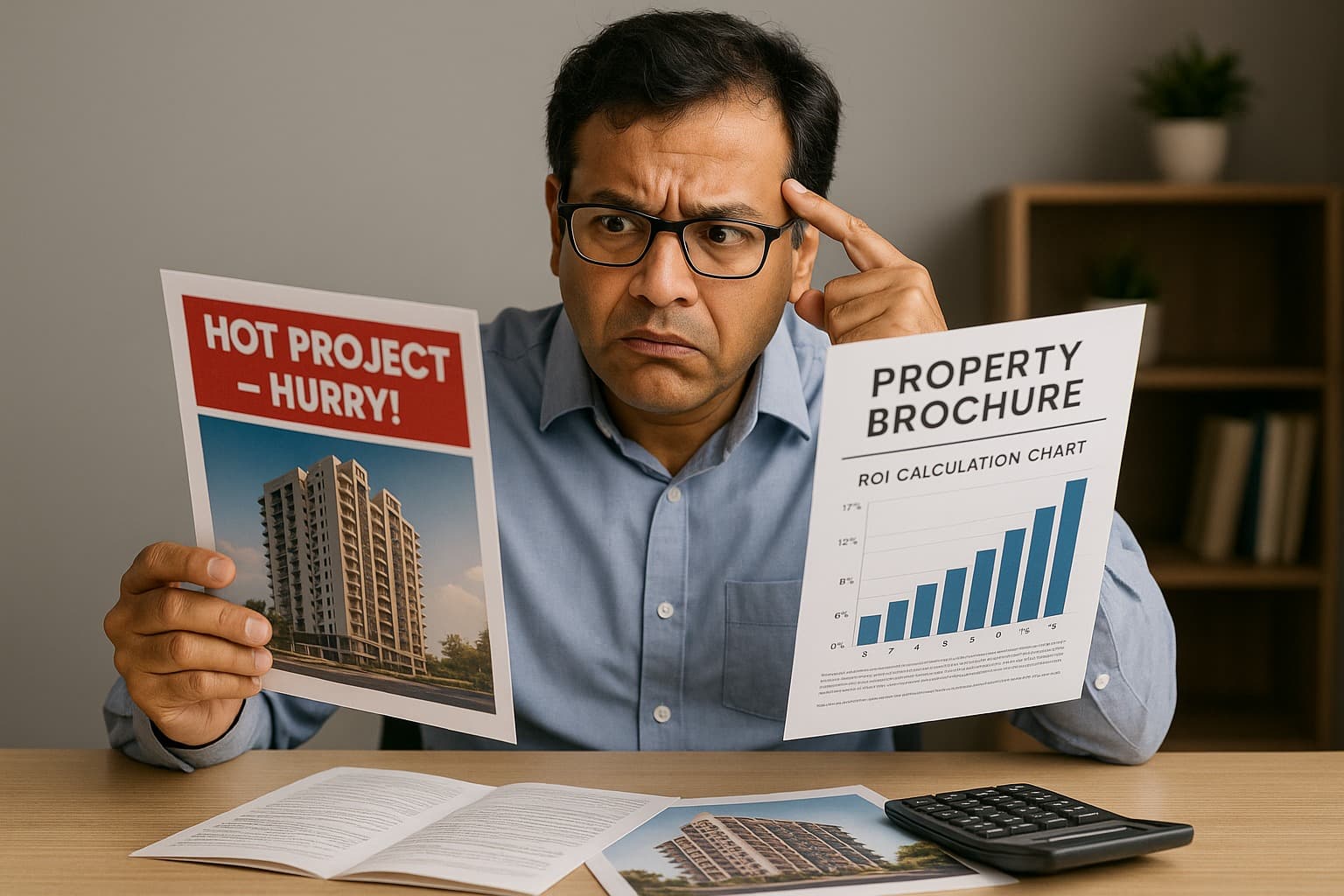

Let’s start with the basics: humans are emotional creatures. We crave security, status, and comfort. In real estate, this translates into investor behaviour in property markets.

Some investors panic when markets dip, selling at a loss.

Others chase “hot” projects because they fear missing out, sometimes overpaying.

Many fall in love with a property and ignore the numbers, thinking it’s perfect even when data says otherwise.

These tendencies, if unchecked, can erode wealth. Recognizing them is the first step to mastering how investor psychology shapes property markets.

Emotional vs Logical Property Buying

Most people buy properties emotionally. The modern kitchen, the balcony with a view, or a vibrant neighborhood triggers instant desire. And that’s okay — emotion often sparks interest.

But to create wealth, you need to balance that with logic.

Emotional buying: You’re attracted to how a property feels.

Logical buying: You analyze location, rental yield, builder reputation, and potential ROI.

Smart investors let emotion drive initial interest but use logic to make the final decision. This is how psychology impacts property investment decisions in India.

Mindset Matters: The Real Estate Investor Mindset

Think of your mindset as a compass. It guides every decision:

Long-term thinking: Real estate is rarely a quick flip; it’s a wealth-building vehicle over years.

Risk-awareness: Markets fluctuate, and patience is often rewarded.

Growth orientation: The best investors actively research neighborhoods, track rental yields, and analyze ROI instead of following hype.

Adopting the real estate investor mindset is what separates profitable investors from those who burn cash chasing emotion.

Common Psychological Biases in Property Investment

To invest wisely, you must recognize cognitive traps:

Herd mentality: Buying just because everyone else is buying.

Overconfidence: Assuming you can predict market highs and lows perfectly.

Anchoring bias: Fixating on the first price seen and comparing all others to it.

Loss aversion: Avoiding good opportunities because of fear of losing money.

Emotional attachment: Falling in love with a property despite red flags.

Think of these as invisible forces nudging your wallet. Being aware of them gives you control.

Case Study: Heart vs Mind

Here’s a real example:

An investor in Pune fell in love with a flat in Viman Nagar. Sunlight, interiors, location — perfect. Emotionally, she wanted it immediately. But she paused and ran the numbers: rental yield, resale potential, and past appreciation trends. Another property nearby had slightly better numbers. She went logical. Two years later, her choice appreciated faster, while the emotionally chosen flat barely moved.

This illustrates investor psychology explained for real estate beginners: emotions feel powerful but can mislead; logic wins in wealth creation.

How Psychology Drives Market Trends

Investor psychology doesn’t just affect individual decisions — it shapes entire markets.

When fear spreads, people sell; prices drop.

When excitement spreads, everyone chases “hot” projects; prices spike.

For example, after metro expansions in Pune or Hyderabad, panic buying in surrounding areas often inflates short-term prices. Investors who anticipate growth and buy calmly tend to earn better returns.

Understanding psychology of real estate investing India helps you read these signals instead of blindly reacting.

Strategies to Align Mindset with Decisions

To invest smarter:

Set clear goals: Define your time horizon, ROI expectations, and risk tolerance.

Research thoroughly: Location, builder, infrastructure, market trends.

Pause before acting: Don’t make decisions in a rush; step back, analyze.

Seek advice: Mentors or advisors often spot emotional blind spots.

Diversify: Spread investments across locations or property types to reduce risk.

Following these steps helps transform impulsive buyers into disciplined investors, mastering emotional vs logical property buying.

Long-Term Wealth Mindset

Investing in real estate is as much about controlling your mind as it is about numbers. Long-term wealth comes from:

Recognizing emotional triggers

Avoiding herd behavior

Making data-backed decisions

Being patient and disciplined

In other words, successful investors aren’t just lucky; they’ve trained themselves to manage their own psychology.

Practical Takeaways

Understand your emotional impulses before viewing properties.

Use logic and metrics — rental yield, appreciation trends, ROI — to make decisions.

Watch market psychology to anticipate trends.

Learn from your mistakes; each emotional buying decision is a lesson.

Align your real estate investor mindset with long-term goals.

By doing this, your property investments are guided by strategy, not impulse.

Final Thoughts

Real estate investing is part numbers, part psychology. Even the smartest investor can falter if emotions cloud judgment. The most successful in real estate India combine analytical thinking with emotional awareness, making decisions that balance heart and head. Understanding how investor psychology shapes property markets and avoiding cognitive traps allows you to confidently navigate the ups and downs of the market.

Summary (100 words)

The psychology of real estate investing is crucial in India’s property markets. Investor behaviour influences buying, selling, and holding patterns, while emotions often clash with logic. Successful investors adopt a disciplined real estate investor mindset, balancing emotional attraction with analytical evaluation of location, ROI, and market trends. Recognizing common psychological biases in property investments, such as herd mentality, overconfidence, or loss aversion, prevents costly mistakes. Understanding how psychology impacts property investment decisions equips investors to act strategically rather than impulsively. By aligning mindset, research, and logic, Indian investors can make informed, profitable real estate decisions and achieve long-term wealth creation.