Pros & Cons of Land Investments: A Relatable Guide for Indian Investors

Summary

Explore the pros and cons of land investments in India for 2025. Discover its unique appeal, potential for appreciation, and risks like low liquidity, helping investors make informed decisions.

Imagine this: You’re walking along a quiet stretch of open land outside a bustling city. The wind rustles the grass, the sun warms your face, and you can almost picture houses, shops, or a small township sprouting here. You think: “Could this piece of land be my future?”

That’s the beauty and challenge of land investment. Unlike flats or apartments, land is tangible, finite, and deeply personal. It can become a source of long-term wealth, but it’s not a “buy-and-forget” type of investment. In 2025, with urban expansion and rising demand for property, understanding the pros and cons of land investment in India is critical for anyone venturing into property investment India.

Why Land Holds a Unique Appeal

Land has a certain magic. You can see it, touch it, and imagine its potential. Unlike stocks, it doesn’t vanish overnight, and unlike gold, it isn’t just a shiny asset — it’s real estate India you can grow with vision.

Scarcity: Land is finite. As cities expand, demand rises, and land value goes up.

Control: You own it outright. No tenants, no immediate maintenance — just the land and its possibilities.

Flexibility: From agricultural plots to residential or commercial land, you can choose a type that matches your goals.

This is why so many investors consider buy land India — not just as an asset, but as a canvas for future growth.

Advantages of Land Investments

Let’s break it down with a human touch:

1. Appreciation Over Time

Land near growing cities, highways, or metro projects tends to appreciate steadily. Many investors see this as one of the main land appreciation benefits India offers. Over a decade or more, the right piece of land can increase manifold in value.

2. Low Maintenance

Unlike residential or commercial property, land doesn’t require tenants, repairs, or renovations. You own it, and it quietly grows in value.

3. Tangibility and Security

There’s a deep psychological comfort in owning land. You can visit it, walk on it, and envision its future. It’s a physical asset that gives peace of mind, unlike digital investments.

4. Flexibility of Use

You can invest in agricultural land, plots for residential construction, or commercial land depending on your goals. Smart investors tailor land investment strategies India to align with emerging opportunities.

Disadvantages of Land Investments

Of course, it’s not all rosy. Understanding the risks of buying land in India is essential:

1. Low Liquidity

Selling land can take months or years, unlike selling a flat or stocks. You need patience and timing.

2. Legal Complexities

Land can carry legal baggage: disputed ownership, incomplete titles, or zoning restrictions. Diligence is critical before buying.

3. No Immediate Income

Land doesn’t generate rent or cash flow. Your gains come mostly from appreciation, which can take years.

4. Market Sensitivity

While land generally appreciates, certain areas may stagnate due to poor development, lack of demand, or regulatory hurdles.

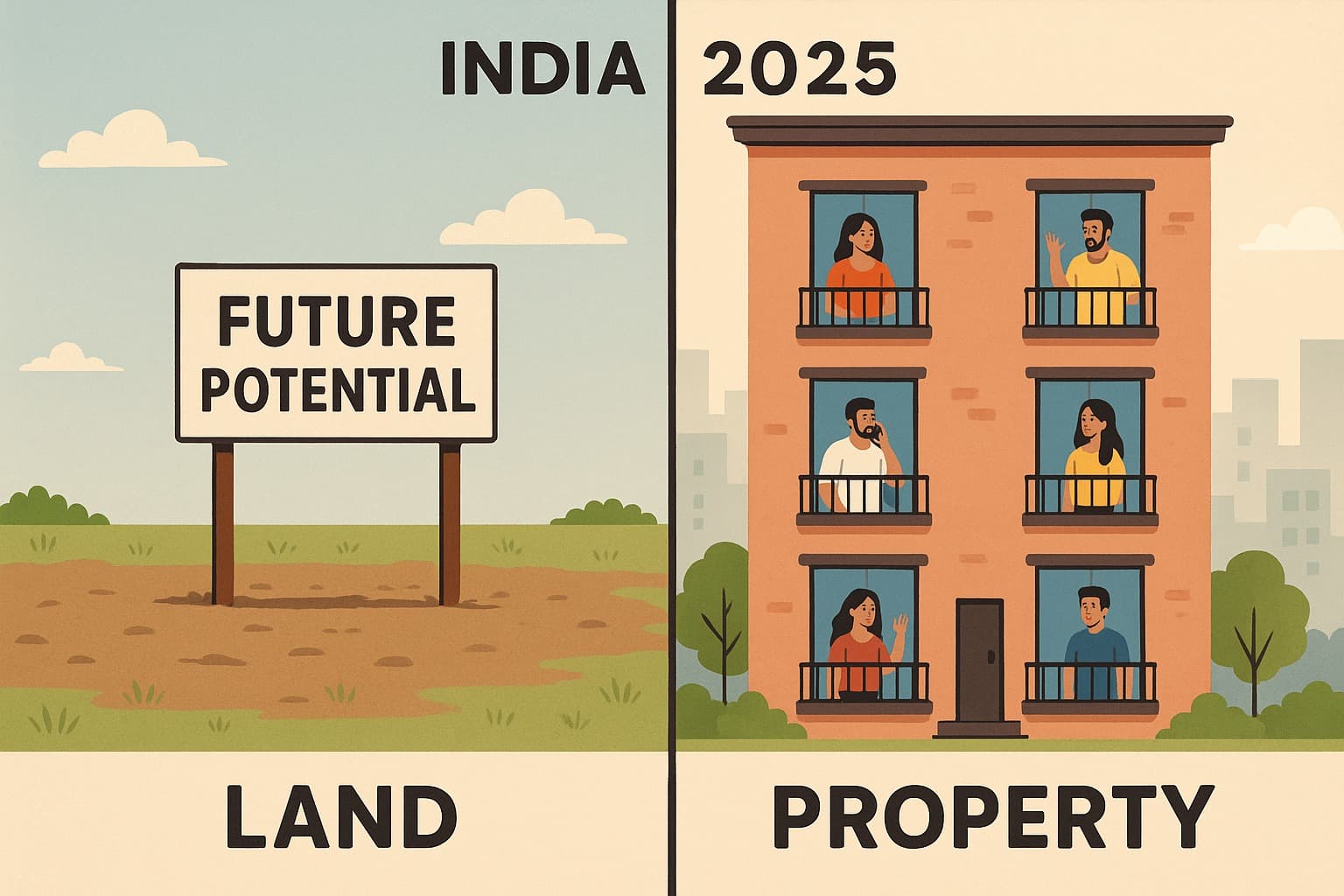

Land vs Property Investment

Investors often ask: land vs property investment — which is better?

Land: High appreciation potential, minimal maintenance, tangible, but no rental income and less liquidity.

Property: Immediate rental income, liquidity, usable asset, but requires upkeep and may depreciate.

Understanding why land investment is different from property investment helps investors make informed choices based on their financial goals and timelines.

Types of Land Investments

Different types of land suit different investor needs:

Agricultural Land: Affordable, potential for future residential/commercial conversion, but may have legal restrictions.

Residential Land: Ideal for constructing homes or selling plots; appreciates faster in urban areas.

Commercial Land: High returns if located near business hubs or infrastructure projects.

When investing, consider pros and cons of agricultural vs residential land carefully. Agricultural land may be cheaper but harder to develop, while residential land offers faster returns but higher upfront costs.

Real-Life Stories

Let’s bring it human.

Sunil, a small-town investor from Maharashtra, bought a 2-acre agricultural plot outside Pune in 2015. At the time, he was skeptical — it didn’t generate rent, and the area felt remote. Fast forward to 2025:

Urban expansion turned the area into a developing residential hub.

Developers approached him to buy the land at five times his purchase price.

Patience and timing made his investment extremely profitable.

This is a perfect example of advantages and disadvantages of land investment in India — land requires foresight and patience, but the rewards can be enormous.

Tips for Safe Land Investment

Check Legal Documents: Title deeds, ownership, zoning, and approvals must be verified.

Location, Location, Location: Invest near growing cities, metro corridors, or infrastructure projects.

Research Future Plans: Municipal and state development plans indicate appreciation potential.

Think Long-Term: Land is a slow but steady wealth creator — don’t expect overnight returns.

Following these tips helps navigate pros and cons of land investment in India safely.

Conclusion

Land investment in India offers unique opportunities for wealth creation. Its appeal lies in land value, low maintenance, flexibility, and long-term appreciation. Yet, it carries risks to consider before buying land in India, including legal complications, low liquidity, and delayed returns.

In 2025, asking is land a good investment option for Indians in 2025 is natural. Investors who research thoroughly, focus on emerging areas, and exercise patience can turn land into a powerful asset. Land remains a fundamentally human investment — tangible, permanent, and full of potential for those who wait and plan wisely.

Summary (100 Words)

Investing in land in India is both rewarding and challenging. Land investment provides low maintenance, tangible ownership, flexibility, and strong land appreciation benefits India, especially near growing urban centers and infrastructure projects. However, it carries risks of buying land in India, including legal complications, low liquidity, and delayed returns. Comparing land vs property investment, investors can choose based on goals — long-term appreciation versus immediate rental income. Understanding pros and cons of agricultural vs residential land and applying thoughtful land investment strategies India ensures sustainable wealth creation. In 2025, land remains a unique avenue for securing financial growth and building lasting assets.