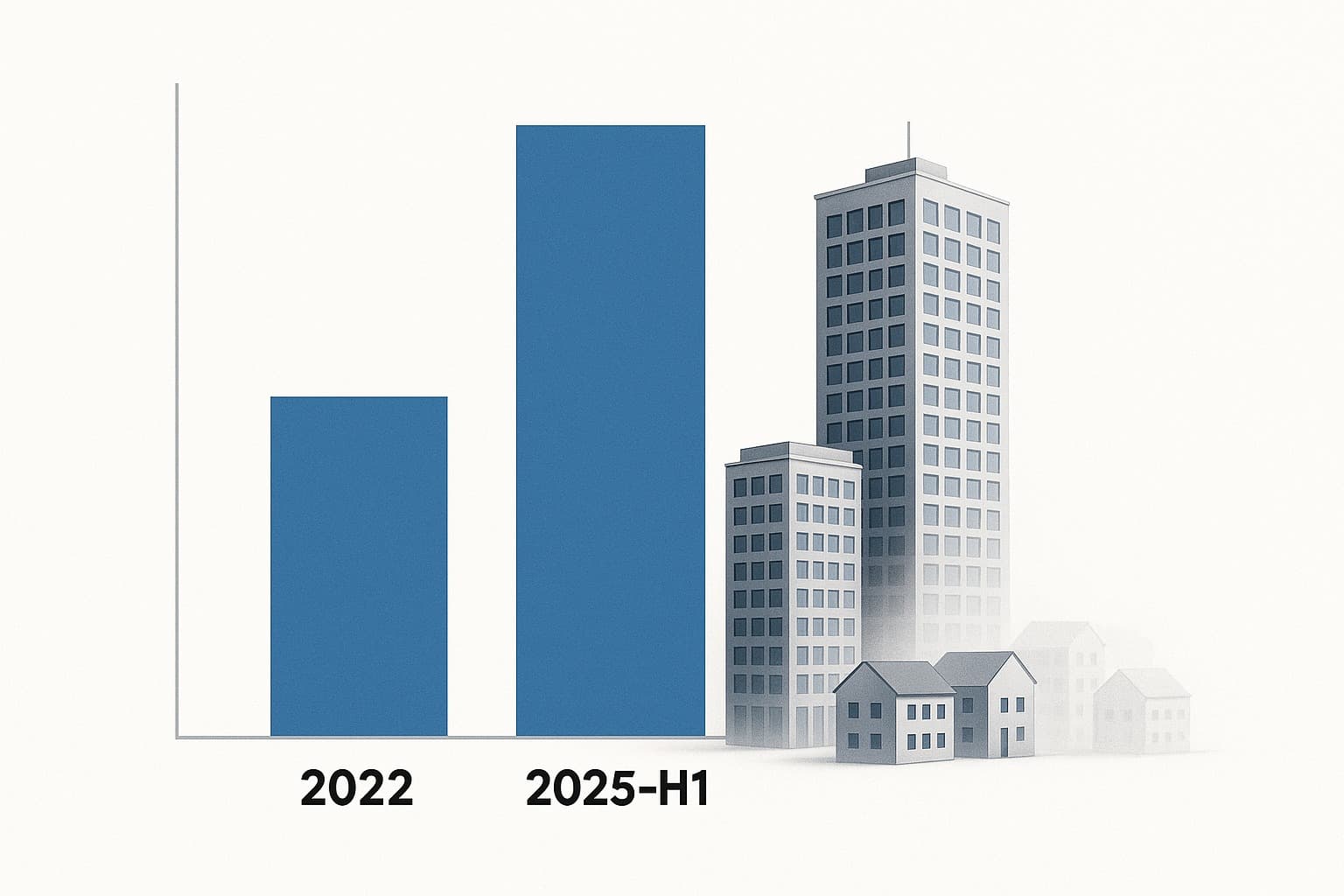

Mumbai & Pune Housing Sales Double in H1 2025, Affordable Housing Declines

Summary

Mumbai & Pune housing sales doubled in H1 2025, reaching 1.05 lakh units, driven by demand for mid & premium segments. Affordable housing is declining due to land scarcity & rising costs, impacting first-time buyers.

The Indian real estate market has shown remarkable resilience in recent years, and Mumbai and Pune housing salesare testament to this trend. According to the latest report, housing sales in these two major metro cities doubled to 1.05 lakh units in the first half of 2025, signaling a robust recovery and strong demand. However, the report also highlighted a concerning trend: the share of affordable housing is declining, making it a critical area of discussion for policymakers, investors, and homebuyers alike.

Housing Sales Surge in Mumbai and Pune

The Mumbai and Pune housing sales report 2025 paints an optimistic picture for India’s real estate sector.

Key Highlights:

Total housing sales in Mumbai and Pune reached 1.05 lakh units in H1 2025, almost doubling compared to previous periods.

The surge is driven by increased demand for residential properties in metro cities, fueled by urbanization, rising incomes, and better connectivity.

Both premium and mid-segment properties saw substantial uptake, reflecting confidence in the real estate market in India.

Experts attribute this growth to multiple factors: improved infrastructure, availability of home loans at competitive rates, and renewed interest from investors seeking long-term property appreciation.

Decline of Affordable Housing

While overall sales are surging, the share of affordable housing in Mumbai and Pune has seen a noticeable decline.

Reasons Behind the Decline:

Land Scarcity: Limited availability of affordable plots in prime city locations pushes prices higher, reducing the supply of budget homes.

Rising Construction Costs: Escalating costs of raw materials impact developers’ ability to launch low-cost housing projects.

Shift in Buyer Preference: Many buyers are now opting for mid-segment or premium housing, seeking better amenities and long-term value.

This decline is significant because affordable housing India has historically been a key driver of mass homeownership and inclusive urban growth. As the report suggests, the shrinking share could have long-term implications for housing demand in India, particularly among first-time buyers.

Pune Property Market on the Rise

Pune, often dubbed the “Oxford of the East,” has seen a steady rise in real estate sales. The Pune property marketbenefits from strong IT and educational hubs, growing employment opportunities, and lifestyle-driven migration.

Highlights for Pune:

Housing sales in Pune contributed significantly to the overall 1.05 lakh units sold in H1 2025.

Mid-segment and premium residential projects are performing well, reflecting changing buyer aspirations.

Developers are increasingly launching projects in suburban Pune to tap into demand while managing costs.

For investors, Pune continues to offer strong growth potential, particularly in areas with emerging infrastructure, metro connectivity, and proximity to IT corridors.

Mumbai Housing Market Trends

Mumbai remains India’s most dynamic real estate market. The Mumbai housing sales report 2025 shows an unprecedented surge in units sold despite challenges such as land constraints and rising construction costs.

Key Observations:

Premium and mid-segment homes are leading sales, while affordable housing continues to shrink.

Localities like Andheri, Powai, Thane, and Navi Mumbai are witnessing high demand due to connectivity and employment hubs.

Mumbai’s housing market is increasingly driven by investment-oriented buyers looking for capital appreciation and rental income.

The report emphasizes that Mumbai’s real estate trends India H1 2025 report reveal a shift in market dynamics: buyers are prioritizing quality, convenience, and lifestyle over sheer affordability.

Drivers Behind Housing Demand in Metro Cities

Several factors are fueling the surge in housing sales in Mumbai and Pune:

Infrastructure Growth: New metro lines, expressways, and business hubs enhance city connectivity, driving residential demand.

Low-Interest Home Loans: Competitive financing options make homeownership more accessible, even for mid-segment buyers.

Migration and Employment Opportunities: Metro cities continue to attract talent from across India, increasing housing demand.

Investor Confidence: With stable returns, investors see residential property as a safe long-term asset.

These drivers underscore why housing sales growth in Mumbai and Pune real estate market is outpacing expectations.

Implications of Declining Affordable Housing

The shrinking share of affordable housing in metro cities is a matter of concern for policymakers and developers:

First-time Buyers: Limited availability of budget homes could delay property ownership for middle-income groups.

Urban Planning: Inclusive urban growth may be impacted if affordable housing options continue to decline.

Investment Strategy: Investors may need to consider mid-segment or premium properties for better ROI, as affordable units remain scarce.

Developers and authorities must work collaboratively to balance housing demand in India while ensuring affordable options remain viable.

Insights for Buyers and Investors

For prospective homebuyers and investors, the report offers several actionable insights:

Focus on Emerging Suburbs: While city centers face affordability issues, suburban areas in Mumbai and Pune offer growth opportunities.

Assess Long-Term ROI: Mid-segment and premium homes in high-demand areas may provide better capital appreciation.

Diversify Property Portfolio: Consider both residential and commercial options to mitigate risks in the fluctuating market.

Stay Updated: Real estate sales data and reports like these help buyers and investors make informed decisions.

By understanding market trends, buyers can align their investment strategy with evolving housing demand in India.

Future Outlook

The real estate report indicates a bright future for metro housing markets:

Sustained Growth: Housing sales are expected to remain strong if economic conditions remain favorable.

Premium & Mid-Segment Focus: Developers are likely to prioritize these segments due to higher demand and better margins.

Policy Support: Government initiatives to promote urban development and real estate reforms could stabilize the market further.

However, addressing the decline of affordable housing in Mumbai and Pune will be crucial to ensure inclusive growth.

Summary (100 Words)

Housing sales in Mumbai and Pune doubled to 1.05 lakh units in H1 2025, highlighting a strong recovery in the real estate market in India. However, the share of affordable housing has declined due to rising costs, limited land, and changing buyer preferences. The surge is led by mid-segment and premium residential properties, with Pune benefiting from IT and educational hubs and Mumbai thriving on connectivity and investment demand. While overall housing demand in India remains robust, policymakers and developers must address the shrinking affordable segment to ensure inclusive urban growth. Metro cities continue to offer high ROI for investors.

Video will be embedded from: https://youtu.be/yl-skInEyA0