How to Diversify a Real Estate Portfolio for Long-Term Growth

Summary

Diversifying your real estate portfolio across property types, locations, and income streams is crucial for long-term growth and risk reduction. Strategic asset allocation and proactive risk management build a resilient investment foundation.

1. Introduction: Why a Balanced Real Estate Portfolio Matters

Building a strong real estate portfolio is not only about buying multiple properties; it is about choosing the right mix that supports stability, growth, and lower risk. Many investors focus on one asset type and later face challenges when the market slows down. This is why investment diversification is essential. When your portfolio includes different property categories, locations, and income patterns, it becomes safer and more resilient. A clear portfolio strategy not only protects your investment capital but also helps you achieve steady long-term returns. Diversification is a thoughtful process, and understanding how it works is the first step toward building a safer and more productive portfolio.

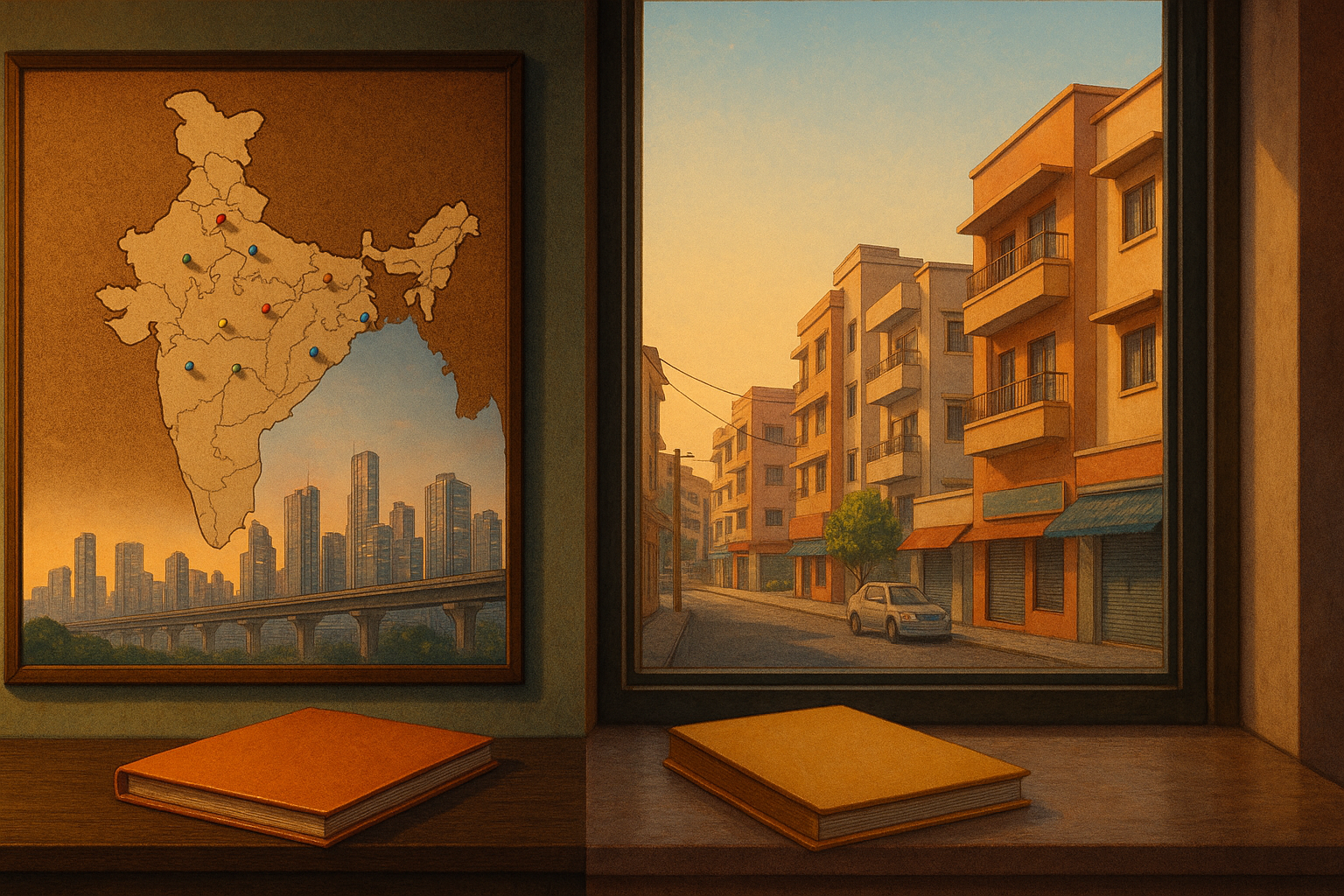

2. Understanding the Concept of Diversified Property Mix

A diversified property mix simply means that your investments are spread across various real estate categories rather than concentrated in one place. You can combine residential units, commercial spaces, rental properties, plots, and even alternative investment options. This approach follows the principle of asset allocation, where each property type plays a different role in the portfolio. When one market segment slows down, the others can balance the performance, allowing investors to maintain stability. Knowing how to diversify your real estate investment portfolio helps you plan better, control risks, and benefit from more than one source of growth.

3. Why Diversification Matters in Property Investment

Investors often depend on a single type of real estate because it feels familiar. However, this can expose them to unnecessary risks. A major slowdown, legal issues, tenant problems, or market cycles can affect a property and reduce returns. This is why why diversification matters in property investment becomes an important question. The simple answer is: diversification protects your money. When your assets are spread out, your exposure to uncertainty reduces. Strategic distribution also leads to opportunities for appreciation in multiple markets. In the long run, risk reduction through property diversification ensures that your financial foundation remains steady, regardless of market fluctuations.

4. Residential vs Commercial: A Smarter Blend

One of the most effective techniques is residential vs commercial diversification. Residential properties offer consistent demand because people always need homes. Commercial assets such as offices, shops, and warehouses usually provide higher rental yields but may be affected by business cycles. When you mix both, you gain the stability of housing demand along with the earning potential of commercial real estate. This balance also increases your chances of steady cash flow. As markets evolve and cities grow, both categories play important roles. Real estate portfolio balancing strategies help you decide how much to allocate to each category.

5. Diversifying Across Locations for Better Protection

You can strengthen your portfolio by spreading investments across different cities and neighbourhoods. A property in one locality may perform differently from another due to demand patterns, economic growth, and infrastructure development. This is where steps to build a balanced property investment portfolio become important. A good location mix may include metro cities, emerging suburbs, and tier-2 cities with strong future potential. Regional diversification protects you from sudden price drops or slowdowns in one area. How to lower risks by spreading investments across property types also applies to spreading them across locations for maximum protection.

6. Combining Residential, Commercial, and Rental Assets

Real estate becomes more dependable when you combine multiple asset classes. You may include premium residential apartments for appreciation, office spaces for rental income, co-living units for continuous occupancy, and retail units for stronger commercial returns. Combining residential, commercial, and rental assets for diversification helps you benefit from different income cycles. This reduces dependence on a single category and creates multiple income streams. Investors who follow such strategies enjoy smoother performance compared to those who invest only in one property type. A mixed-asset approach also increases long-term security.

7. Managing Risks Through Smart Portfolio Planning

A key purpose of diversification is controlling risks. Many investors underestimate market uncertainties, tenant changes, and cost fluctuations. Learning how to diversify real estate portfolio for better returns and safety teaches you to analyse potential risks before investing. For example, commercial spaces require longer vacancy planning, while residential units demand maintenance planning. By preparing for these challenges, investors improve their portfolio performance. Smart planning also helps in identifying opportunities early. A risk-aware mindset creates a strong foundation for financial growth.

8. Common Real Estate Pitfalls and How to Avoid Them

Many investors make errors by following market trends blindly or selecting properties without proper research. These mistakes affect long-term performance. Learning about common real estate pitfalls and how to avoid them helps you stay alert. Over-investing in one geographic area, ignoring rental potential, or buying without checking legal approvals is risky. A diversified strategy demands patience, evaluation, and careful selection. Investors must avoid emotional decisions and rely on data, demand patterns, and long-term goals.

9. Practical Tips to Implement Portfolio Diversification

To effectively diversify, start by analysing your current investments. Then assess gaps in your portfolio—whether you need more rental income, better appreciation potential, or broader geographic spread. Explore new markets, study infrastructure development, and track economic growth. Consult experts if necessary. Use insights from risk management strategies for real estate investors to make better decisions. As you gradually expand your portfolio, ensure each property adds value and strengthens your overall financial stability. Diversification is a continuous process, and reviewing your assets regularly will help you maintain balance and long-term success.

Summary

A well-built real estate portfolio becomes stronger when it includes different property types, locations, and income sources. Through thoughtful investment diversification, investors reduce risks and gain long-term stability. A proper property mix that blends residential, commercial, and rental assets helps balance performance during market changes. Using effective portfolio strategy and location-based planning ensures steady growth. By avoiding common mistakes and spreading investments wisely, investors protect their capital and create safer pathways for financial progress. Diversification remains one of the most reliable ways to build sustainable real estate wealth.