Foreign Investors Reshaping Indian Real Estate in 2025

Summary

Foreign investment is reshaping Indian real estate in 2025, driving growth and higher standards. NRIs and global funds focus on residential and commercial properties, creating opportunities for all investors.

Picture this: a group of investors in Singapore or London, sipping espresso in a high-rise office, scanning Indian property markets. They’re not thinking about Bollywood or street food; they’re focused on Indian real estate, and they’re serious. In 2025, foreign investors are reshaping India’s property landscape, and their influence is impossible to ignore. If you’re an NRI, domestic investor, or even a first-time property buyer, understanding these trends isn’t optional — it’s essential.

Foreign capital isn’t just a side story anymore. It’s one of the main drivers of growth, professionalism, and innovation in real estate India. Let’s explore why these investors are flocking to India, what they’re buying, and how it impacts the local market.

Why Foreign Investors Prefer Indian Real Estate 🌏🏢

So why is India suddenly on the global real estate radar? Several factors come into play:

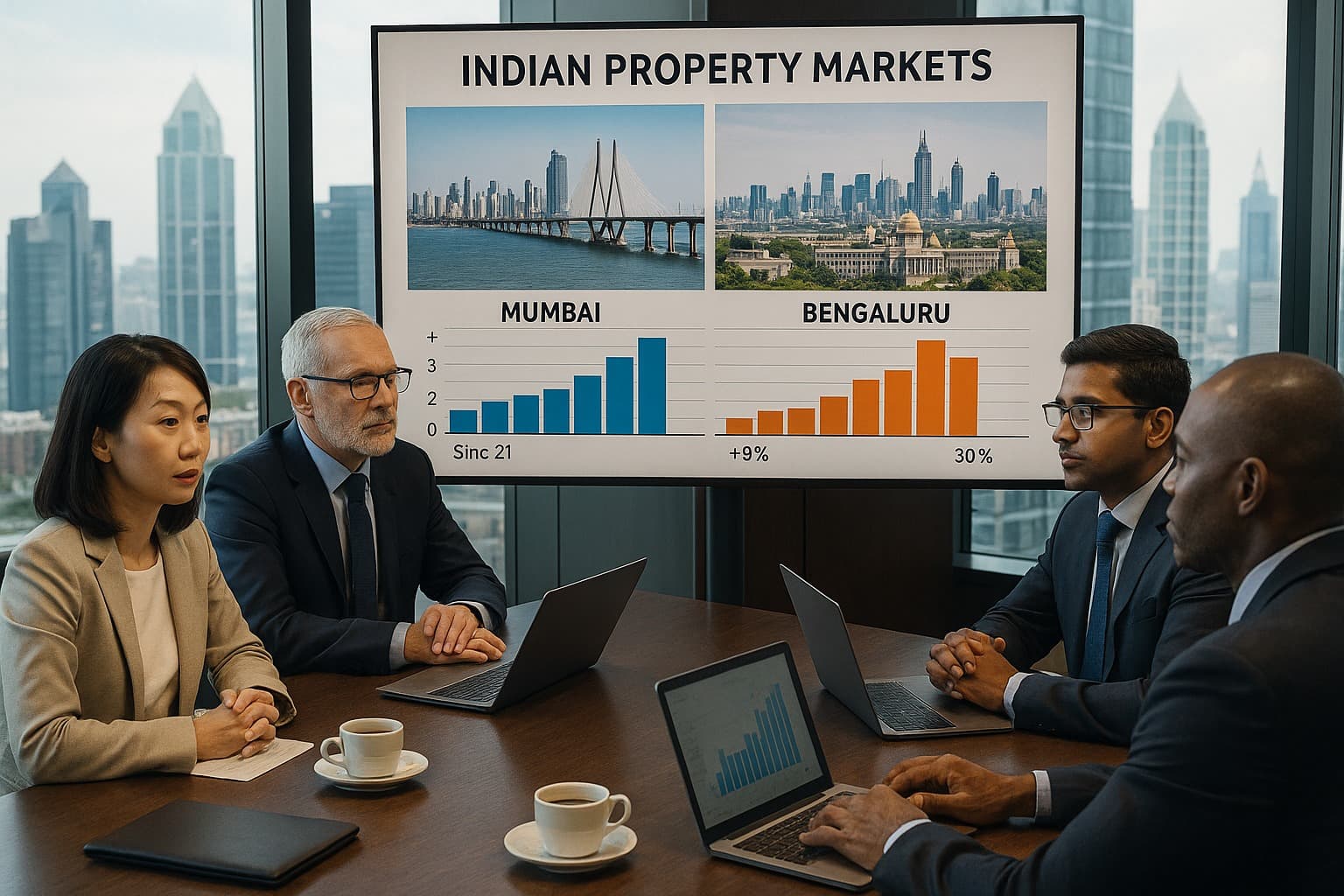

High growth potential: India’s cities are expanding fast. Cities like Mumbai, Bengaluru, Pune, and Gurugram are seeing rising demand for office spaces, residential complexes, and commercial hubs. For a global investor, this means long-term appreciation.

Stable returns: Unlike the unpredictable stock market, real estate offers more predictable income through rentals. A fully leased office in a commercial hub guarantees cash flow month after month.

Diversification: Global investors are always on the lookout for assets outside their home country. Indian real estate provides a perfect mix of growth and security.

Favorable policies: With FDI in Indian property sector 2025 becoming more structured, regulations are clearer, making it safer for foreign players to invest.

In short, India offers the sweet spot of high returns, legal clarity, and long-term stability — a rare combination in emerging markets.

NRI and Foreign Investment Trends

NRIs have always been a vital part of India’s real estate ecosystem. Many Indians working abroad want to invest in homes back in India — partly for rental income, partly for family security. But 2025 has seen foreign investors in Indian real estate market expanding far beyond NRIs.

NRIs tend to prefer residential properties near IT hubs or metro cities, looking for safe appreciation and rental yields.

Institutional foreign investors, including private equity funds, are targeting commercial real estate — office spaces, malls, and logistics parks.

This combination is powerful. It creates a more professional, transparent, and liquid real estate India, benefiting everyone from small-time homebuyers to domestic investors.

The Role of FDI in Indian Real Estate 💹

FDI has become a cornerstone for property development in India. Its influence is tangible:

Capital inflow: Foreign investment brings large sums that help developers execute bigger, better projects.

Transparency: Institutional investors demand structured contracts, RERA compliance, and timely delivery. This raises standards across the board.

Professionalism: Projects backed by foreign investors often adhere to international construction standards and property management practices.

Simply put, impact of FDI on India’s real estate sector is not just financial — it elevates quality, trust, and predictability in the market.

Opportunities for Global Investors 🌟

For global investors looking at opportunities for foreign capital in Indian property, here’s where the action is:

Commercial hubs: Mumbai, Gurugram, and Bengaluru offices leased to multinational corporations.

Residential hotspots: Pune, Hyderabad, and Noida for rental income and steady appreciation.

Logistics parks and SEZs: With e-commerce booming, these properties are extremely attractive for high-yield returns.

These sectors allow investors to diversify within India, balancing risk and reward, while capitalizing on the country’s rapid urbanization.

Impact on Local Investors 🏘️

The influx of foreign capital does not just benefit global investors — it also improves opportunities for domestic buyers.

Higher transparency and stricter regulations make markets safer.

Developers are motivated to deliver quality projects, which benefits everyone.

Areas attracting foreign investment often see faster price appreciation.

For example, Pune’s IT corridors have seen rising foreign interest. A domestic investor who buys in the same area benefits from infrastructure, rising demand, and increasing property values.

Real Estate FDI Rules India

Of course, there are rules. Understanding real estate FDI rules India is essential for anyone hoping to invest safely.

NRIs can invest freely in residential and commercial properties.

Foreign companies and funds can invest through approved FDI channels, usually in commercial properties or large residential townships.

Compliance with minimum capital requirements and regulatory filings is mandatory.

A solid understanding of these rules ensures investors avoid legal complications while benefiting from growth.

Success Stories

Let’s make this relatable. A foreign fund invested in a Bengaluru office park in 2023. The fund brought ₹150 crore to develop a Grade-A building leased to top tech companies. Domestic investors who partnered or co-invested saw steady rental income, and after two years, the property’s value had appreciated by over 20%.

Similarly, NRIs investing in residential complexes in Pune or Hyderabad earned rental yields while their properties appreciated, demonstrating how foreign investors driving Indian real estate growth 2025 is not just theoretical — it’s real money in real projects.

Challenges & Risks

Not everything is perfect. Foreign investment can sometimes create competition, driving up property prices, which may make it harder for small domestic investors to enter. Additionally, global market fluctuations, currency risk, and political or regulatory changes can affect returns.

Being aware of these risks is critical. A balanced approach — investing alongside or in areas with foreign interest while ensuring your due diligence — is the safest way forward.

The Takeaway

Foreign investors are reshaping India’s property markets. Their presence improves standards, increases liquidity, and often leads to faster appreciation in key locations. NRIs and domestic investors can benefit by understanding why foreign capital is entering Indian property markets and leveraging opportunities for strategic investment.

If you’re planning to invest in 2025, watch where foreign investors are putting money — chances are, those locations and property types are the safest bets for growth.

Summary (100 words)

Foreign investors and NRIs are reshaping the Indian real estate market in 2025. With FDI in Indian property sector 2025, global investors bring capital, transparency, and quality to residential, commercial, and logistics properties. NRIs focus on residential investments near IT hubs, while foreign funds target commercial real estate. This trend drives foreign investors in Indian real estate market, creating safer, higher-quality projects with better returns. Understanding real estate FDI rules India, tracking foreign investment trends in India’s real estate industry, and observing where foreign capital is flowing can help domestic and global investors make informed, profitable property investment decisions in India.