Diversifying Your Portfolio with Property in India

Summary

Diversifying with Indian property balances risk and growth. Real estate offers stability, rental income, and appreciation, complementing stocks and bonds for a resilient portfolio. Explore residential, commercial, and geographical diversification.

Picture this: You’re sipping chai on a Sunday morning, checking your portfolio. Stocks have surged and dropped in the same week, your mutual funds are doing their roller-coaster dance, and gold is…well, glimmering, but not growing much. Suddenly, you think — maybe it’s time to bring some stability into this mix. Enter real estate investment. In India, property isn’t just a tangible asset; it’s a powerful way to diversify portfolio, protect wealth, and create steady returns. For investors looking to balance risk and growth, real estate India has become a cornerstone of smart investment strategies.

Why Property is Crucial for Diversification

Seasoned investors know: never put all your eggs in one basket. Stocks can soar, but they can crash overnight. Gold is a hedge, yes, but it rarely offers steady cash flow. Portfolio diversification with real estate India adds a stabilizing layer. Unlike equities, property values move gradually and provide property ROI through both appreciation and rental income.

Consider Rajesh, a 40-year-old investor in Pune. His portfolio was mostly stocks and mutual funds. When the market dipped, he felt the stress immediately. A year later, he added a residential flat near Hinjewadi and a small commercial unit near Wakad. The rental income from these properties cushioned market volatility and improved overall returns. This is why real estate as a diversification tool is so compelling.

How Property Complements Your Existing Investments

Think of property as the calm in a stormy financial sea. Equities give you growth; bonds offer stability; property provides both stability and cash flow. Here’s how:

Stability: Real estate is less volatile than stocks. Property values don’t swing wildly overnight.

Rental Income: A flat in a prime location can generate consistent income, contributing to your wealth buildingstrategy.

Inflation Hedge: Property prices and rents generally rise with inflation, protecting purchasing power.

Capital Appreciation: In high-growth urban areas, property appreciates steadily, boosting long-term property ROI.

This is why best strategies to diversify property investments often suggest a mix of residential and commercial properties across cities.

Residential vs Commercial Property

Balancing residential and commercial properties is a key part of real estate diversification tips for Indian investors 2025.

Residential Properties: Provide stable rental income and easier management. Ideal for locations near schools, hospitals, and workplaces.

Commercial Properties: Higher property ROI potential through long-term corporate leases, especially near tech parks, business hubs, and emerging commercial corridors.

Combining both types reduces risk while maximizing returns, aligning perfectly with role of property in portfolio diversification for investors.

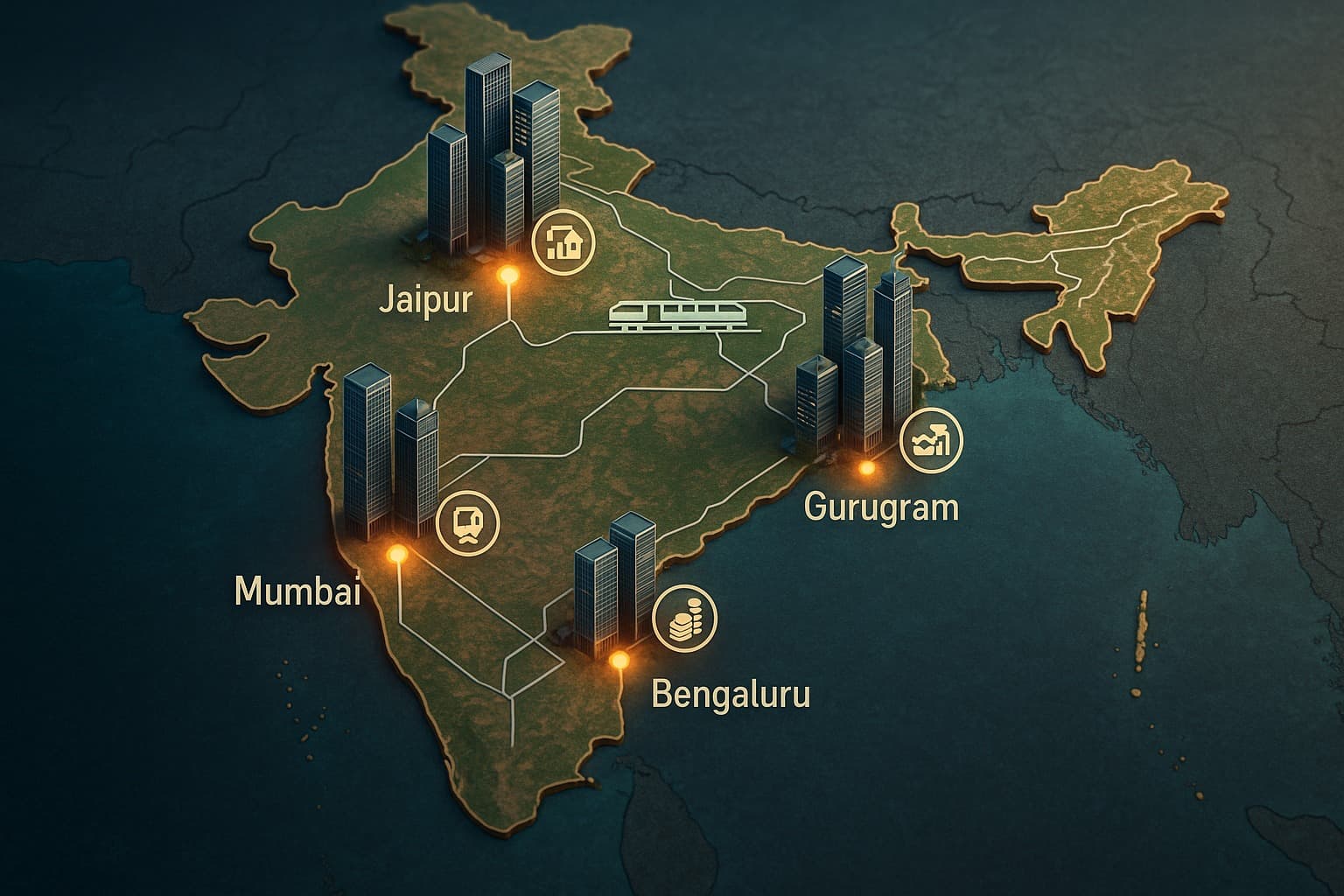

Geographical Diversification

Location matters. Investing in multiple cities mitigates risk from local market fluctuations. Examples of high-potential locations for real estate as a diversification tool include:

Bengaluru & Pune: IT-driven growth and high rental demand

Mumbai & Gurugram: Premium residential and commercial appreciation

Tier-2 cities like Jaipur & Kochi: Emerging markets with affordable entry points

By spreading investments across multiple regions, you ensure your portfolio remains resilient, reflecting diversification benefits through property.

Property vs Stock Diversification

Many investors wonder: property vs stock diversification India — which is better? The answer: both. Equities offer liquidity and rapid growth potential; real estate offers stability, passive income, and tangible assets. A blended portfolio balances volatility and growth.

Example: During a market correction, rental income from property cushions the impact, while stocks recover over time. This creates a natural hedge and illustrates how to diversify your investment portfolio with real estate.

Practical Strategies for Diversifying with Property

Mix Property Types: Residential for steady income; commercial for higher long-term ROI.

Invest Across Cities: Diversify geographically to capture multiple growth trends.

Focus on Rental Income: Predictable cash flow complements volatile markets.

Explore Fractional Ownership & REITs: Allows diversification without huge capital.

Monitor Infrastructure Trends: Areas near metro lines, highways, and business hubs often yield higher appreciation.

Applying these steps ensures you leverage best real estate diversification strategies in India, optimizing both property ROI and portfolio resilience.

Real-Life Scenario

Take Ananya, a 35-year-old investor in Bengaluru. Her portfolio was heavily in stocks and gold. After a market slump, she decided to diversify with property:

Bought a residential flat in Whitefield for rental income

Invested in a commercial office space near Electronic City

Acquired a fraction of a REIT to diversify capital

Within two years, even with stock volatility, her rental income remained steady, property appreciated, and her portfolio’s overall stability improved. This is a perfect example of role of property in portfolio diversification for investors in action.

Future Outlook

Real estate India continues to be a strong diversification tool for 2025 and beyond. Urbanization, metro expansion, and growing demand for residential and commercial spaces make property a resilient investment. Combining property with stocks, bonds, and gold can optimize risk-adjusted returns while providing long-term growth and stability.

Investors should consider:

Emerging Tier-2 cities for high growth potential

Co-working hubs and commercial spaces in metro areas

Fractional ownership and REITs for flexible diversification

By following these real estate diversification tips for Indian investors 2025, portfolios can achieve balance, resilience, and growth.

Final Thoughts

Portfolio diversification with property is essential for sustainable wealth building. Real estate offers stability, passive income, inflation protection, and capital appreciation. Using best strategies to diversify property investments, investors in India can improve property ROI, reduce risk, and strengthen their long-term portfolio. The key is to balance property types, locations, and scales while leveraging both traditional and modern investment tools. Properly executed, property becomes more than an asset — it becomes a reliable anchor in an ever-changing financial landscape.

Summary (100 words)

Diversifying your portfolio with real estate investment is a smart strategy to mitigate risk, generate passive income, and enhance property ROI. Portfolio diversification with real estate India involves combining residential and commercial properties, investing across cities, and leveraging rental income. Compared with stocks, real estate provides stability and long-term growth, making it a key component of wealth building. Using fractional ownership, REITs, and location diversification allows investors to optimize returns. By understanding how to diversify your investment portfolio with real estate and applying real estate diversification tips for Indian investors 2025, investors can create a balanced, resilient, and growth-oriented portfolio.